Best Precious Metal IRA Companies of 2023

January 17, 2023 - Written by Daniel Morse

In 2023, traditional retirement accounts are continuing to lose their value and are no longer considered a trustworthy investment. Savvy investors are more frequently rolling over their IRAs and 401Ks into precious metal IRAs.

If you're looking to do the same, take a look at the top 5 precious metal IRA companies on the market. Our list is based on official business ratings, experience, transparency, and customer feedback.

#1

Goldco: Best business ratings & customer service

4.9/5

#2

American Hartford Gold: Most recognized brand

4.8/5

#3

Augusta Precious Metals: Best customer feedback

4.7/5

#4

Birch Gold Group: Most experience

4.5/5

#5

Noble Gold Investments: Lowest minimum

4.3/5

#1: Goldco

Goldco Precious Metals is our choice for the #1 precious metal IRA company. The company specializes in helping investors safeguard their retirement by diversifying into gold and silver. Goldco has a solid reputation and great business ratings which they have kept the entire time they’ve been in business.

Their precious metal agents are knowledgable, professional, and make the investing process simple and painless. Goldco’s team walks you through every step of the investment process.

What makes Goldco stand apart from their competitors are their no-pressure sales approach, great customer feedback, and white-glove customer service. They are a professional company and do a great job in ensuring your investment process is handled correctly.

Gold IRA Fees

The required minimum purchase at Goldco to start a gold IRA is $25,000. Goldco’s preferred Custodian charges a flat annual account service fee which includes a one-time IRA account set-up fee of $50, as well as a $30 wire fee. Annual maintenance is $100, and storage is $150 for segregated storage or $100 for non-segregated storage.

Fees for gold storage and custodianship can vary depending on the company you select to handle these services (required by the IRS, as all IRA assets must be managed by a custodian). Depending on the Custodian, storage fees can range from $10 to $60 per month, or as a percentage of assets, from 0.35% to 1% annually. Goldco does not charge any storage fees for cash transactions over $25,000.

About Goldco Precious Metals

Goldco was founded in 2006 and has since upheld its mission which is: "helping Americans achieve greater financial security by providing effective solutions that can help protect their retirement."

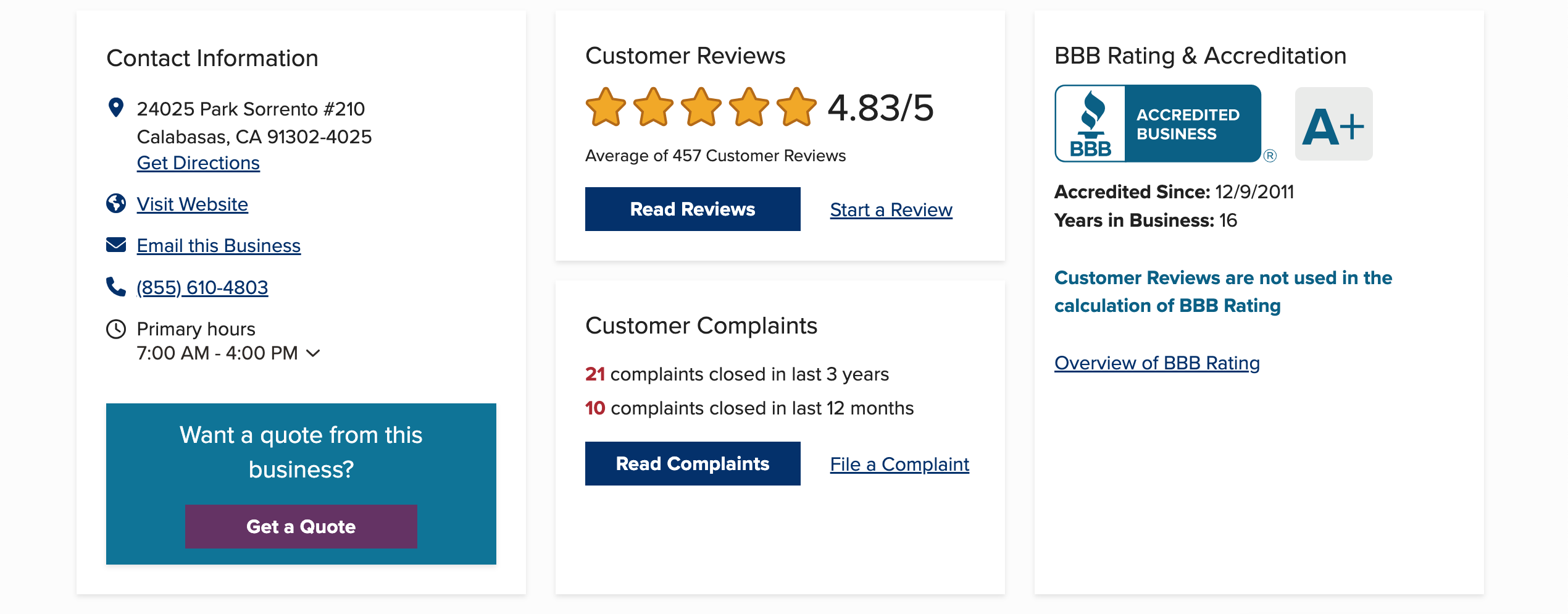

Goldco ranks in the top 1% of the IRA industry for business ratings. They have an AAA with the Business Consumer Alliance, an A+ with the BBB, and a 4.8 on TrustPilot.

Goldco Pros and Cons

Pros

Cons

#2: American Hartford Gold

American Hartford Gold is a family-owned gold and silver IRA provider that has an impressive track record of happy customers and great feedback. American Hartford has facilitated over $1 billion is precious metal investments; they have a ton of experience and are one of the most well-known companies on the market. Their specialists have a deep knowledge of the industry, and they can help to customize your investment and ensure its right for you and your investment goals.

In addition to its IRA and asset protection services, American Hartford Gold also stands apart for its great buyback program. American Hartford Gold has an extensive investor education program. They will help you learn about the various types of metals available and their benefits.

American Hartford Gold has a solid selection of metals, which includes silver, platinum, and palladium. For new customers, the company offers a free one year of gold and silver. You can also take advantage of its silver buyback program.

They have an A+ rating from the Better Business Bureau and an AAA rating from the Business Consumer Alliance.

Some of the company's perks include no fees for the first year of the account, no storage fees, and a great selection of coins.

American Hartford Gold Pros and Cons

Pros

Cons

#3: Augusta Precious Metals

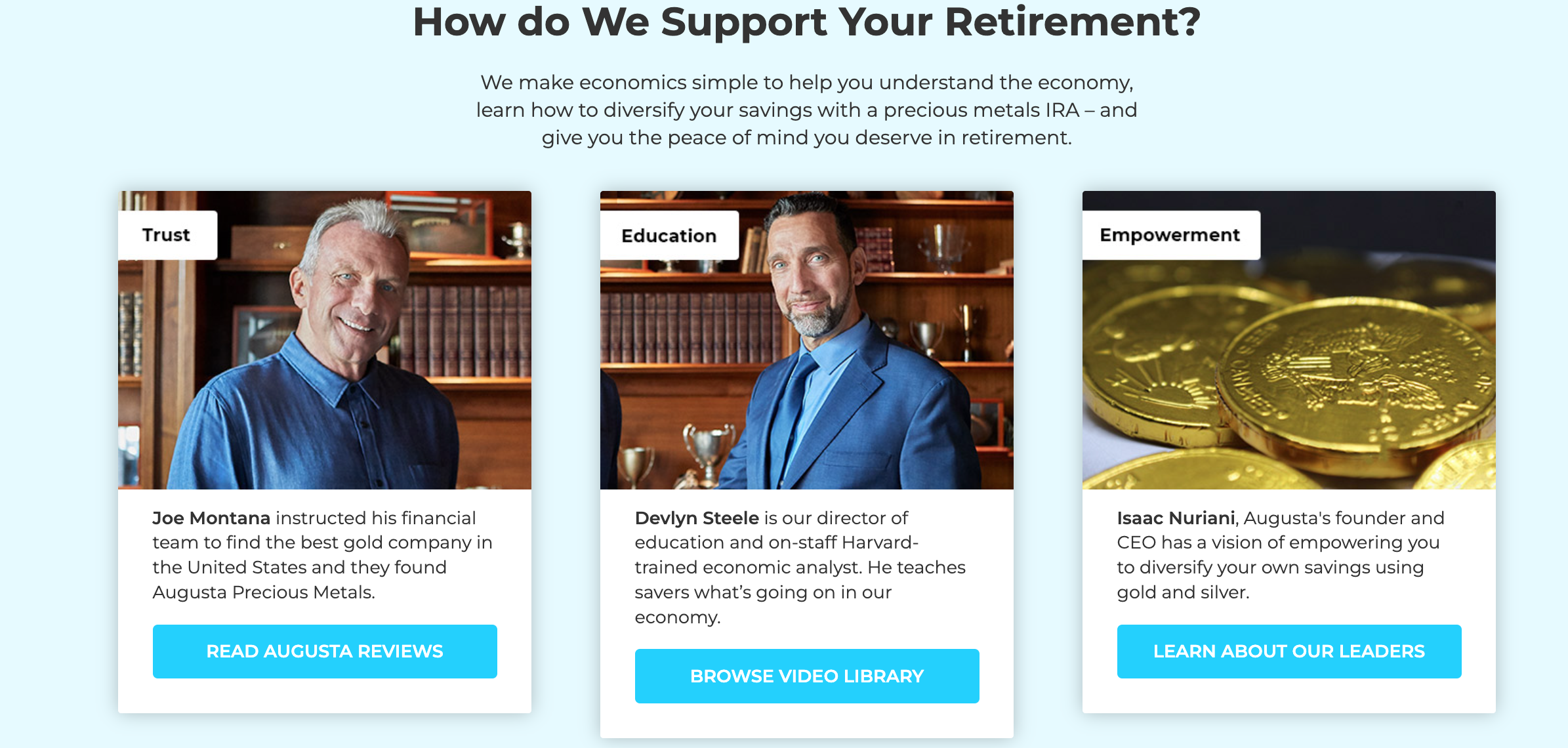

Augusta Precious Metals is a well-rated gold IRA company with terrific customer feedback. They give all of their customers lifetime support and put education first. They ensure every one of their customers are well-versed on gold and silver and the happenings of the financial market as a whole. Augusta has a unique one-on-one web conference with their Harvard economist. During your conference you get all the latest education information and get to ask any questions you may have for an expert in the field. They also have a great reputation for transparency in pricing and fees.

Augusta's main goal is to help soon-to-be retirees diversify their retirement funds. Augusta Precious Metals has received an A+ rating from the Better Business Bureau. In addition to that, the company has an excellent reputation for customer service. For new customers, they offer a seven-day money-back guarantee. This is an attractive option for investors looking to get a feel for the products before buying them.

Customers who choose to purchase a gold and silver IRA with Augusta Precious Metals can rest assured that they are getting high quality service with a professional company. Their agents educate customers and take the time to walk you through every step of the investment process.

For those who are considering investing in an IRA, the minimum investment amount with Augusta is $50,000. There are no hidden commissions or fees. However, there is a yearly maintenance fee of $180.

Augusta Precious Metals makes it easy to build an IRA by ensuring that you understand the process and by offering lifetime customer support. Plus, they also provide ongoing extensive educational materials.

Augusta Precious Metals Pros and Cons

Pros

Cons

#4: Birch Gold Group

If you are looking for one of the best precious metal IRA companies, Birch is another great option. The company has an excellent reputation, a wide variety of products, and the most experience of any company on this list. They also have specialists on hand to help you make the right decisions for your portfolio.

Birch Gold Group has been in business for over two decades, and they have a vast amount of experience in the IRA industry. Their customer service is second to none.

You can buy silver and gold from Birch Gold Group in a variety of different IRAs. For example, you can buy a silver IRA or a palladium IRA in addition to gold and silver.

Another great feature of the Birch Gold website is that you can find all of your information in one convenient place. Whether you want to learn about the precious metals, find out how to invest, or just look at the prices, you can do so from the comfort of your own home.

Investing in physical metals can be intimidating at first, so it's important to find a company that walks you through the entire process. Also, you should ask for advice from a trusted specialist before you buy. This can make all the difference in the world.

Birch Gold Group Pros and Cons

Pros

Cons

#5: Noble Gold Investments

If you're looking to add precious metals to your retirement portfolio, there are many gold IRA companies to choose from. Choosing a reputable provider can ensure your gold meets the standards of the IRS.

While some of these companies focus only on gold, others offer palladium and silver products as well. Having a diverse investment portfolio is essential to hedge against inflation. It's also a good way to diversify your portfolio in the event of a stock market crash.

The best gold IRA companies make funding and managing your account easy. They also offer a variety of valuable educational resources. You can access your account online at any time.

Some of these companies offer buyback programs, which allows you to sell your gold back to the company. This makes it much easier for you to get the most value for your money.

Noble Gold is one of the best gold IRA companies for several reasons. First, it has been ranked highly by third-party watchdogs. Second, it provides competitive prices for its gold purchases. Third, it offers collectible coins that have historical value. And finally, it has a custodian that uses International Depository Services to store its inventory.

Lastly, it has an A+ rating with the Better Business Bureau. In addition to its excellent customer service, it has an extensive product lineup.

Whether you want to start investing in precious metals or already have an IRA, it's best to consult a financial advisor. Your adviser can determine the best gold IRA for you.

With so many options available, you'll want to choose the right one. Read consumer reviews and check the Better Business Bureau for reviews on the companies that interest you.

Gold IRA FAQ

If you are considering using your traditional IRA account for a gold IRA, it is important to know what you will be paying in fees. You also need to consider how much you will be able to withdraw in the future. Also, you need to be sure that the gold you choose meets all the IRS criteria.

IRA-eligible gold must meet IRS criteria

If you are thinking about investing in precious metals through your Individual Retirement Account, you must understand how the IRS treats gold. Unlike other forms of retirement accounts, IRA-eligible gold must meet certain IRS requirements.

The Internal Revenue Service (IRS) regulates the possession and storage of IRA-eligible gold and other precious metals. To comply with these regulations, IRA-eligible gold and other metals must be kept in the custody of an approved custodian. In addition, IRA-eligible gold and metals can only be stored in an approved depository.

A custodian may be a bank, savings and loan association, or other entity that is approved by the IRS. An approved custodian is responsible for ensuring that your IRA is compliant with all laws and regulations. It is important to choose a custodian who is reliable and reputable. You should be sure to receive accurate information regarding fees and insurance.

IRA-eligible gold and other forms of bullion must be produced by accredited manufacturers and refiners. The gold and other bullion must meet the minimum purity and fineness requirements for IRA-eligible gold. Some forms of bullion are allowed for IRAs, including bars and silver rounds.

Gold and other bullion are considered collectibles by the IRS. However, IRA-eligible gold and silver can be a good way to hedge against inflation and volatile assets.

Depending on your situation, it might make more sense to store your gold outside of your IRA. This could help you to reduce your tax burden in the long run.

Generally, IRA-eligible gold and precious metals must be held in an IRS-approved depository or segregated storage. These are highly secure storage facilities for precious metals.

There are some coins and bullion that can be stored in your home, but most IRA custodians will not allow you to do this. Keeping your IRA-eligible gold at home can result in penalties.

IRA-compatible or IRS-approved bullion

IRA-compatible or IRS-approved bullion is a type of gold investment. It is safe, reliable, and provides tax benefits. The Internal Revenue Service has strict guidelines for saving and investing in precious metals.

These types of investments have been around for centuries and have been used as hedges against inflation and rising cost of living. They are also useful in diversifying an investment portfolio. However, they should be stored in an approved location.

You can buy IRA-compatible or IRS-approved bullion from a number of brokers. Most of them will have symbols that mark products for IRA use.

To be eligible for IRA-approved bullion, a product must meet specific fineness and purity standards. In addition, a bar or round must be produced by an accredited source.

Purchasing IRA-compatible or IRS-approved bullion requires that you choose a custodian that is accepted by the IRS. This can be a bank, credit union, or other trusted organization. Typically, a custodian will hold a gold account in its custody, keep accounts of any new purchases, and collect taxes on any withdrawals.

The IRS has a list of approved storage depositories. Gold must be kept in a place where it will not be stolen or lost. An acceptable facility for storing IRA-compatible or IRS-approved bullion includes a bank, trust company, or an approved COMEX depository.

Some IRA companies offer a sliding scale fee depending on the value of your assets. These fees vary, but may include a one-time set-up fee and a yearly custodial fee.

There are a few other options, such as a self-directed IRA. Self-directed IRAs allow you to manage and own your own gold, but you cannot take it home until after distribution.

IRA storage of gold bullion is a risky option

It is possible to store gold bullion in an IRA, but it is not recommended. There are several issues that make this option a dud.

First, the IRS does not allow individuals to act as their own custodian of retirement savings. Instead, the trustee of an IRA must be a bank, credit union, or savings and loan association. This makes it much harder to set up and manage a gold IRA.

Second, the price of gold has increased dramatically over the past decade. In addition, the IRS is now more strict. So it is a good idea to choose a trustworthy custodian.

Third, if you have a self-directed IRA, you cannot use home storage. If you want to store your gold, you will have to open an account with a third party. The fees will vary based on the size of your account. For example, Diamond State charges $375 on average for a $50,000 account.

Finally, keep in mind that the benefits of storing your gold at home are limited. While it might be convenient to be able to see your gold at all times, you may not want to store it in your home. Besides, you may not have the right equipment or security measures to ensure your security.

One way to minimize these risks is to hold your gold bullion in a self-directed IRA. Depending on your choice of custodian, the fees might be lower than the ones you would have to pay to store the metals in your home.

The key to success with this kind of investment is to make sure that the company handling your gold has the right licenses, insurance, and bonds.

Fees to pay when you transfer a traditional IRA to a gold IRA

If you're looking to transfer a traditional IRA to a gold IRA, you'll need to find a gold IRA company that is IRS-approved. These firms will help you open and fund the account. They will also coordinate the necessary paperwork for the transaction.

There are a number of fees to consider when you're transferring a traditional IRA to a gold investment. Depending on the type of investment, the fees can range from one-time setup charges to yearly maintenance costs.

Most gold IRA companies will recommend a specific depository, or financial institution. This helps you avoid the need to go to a different company for every transaction. Some companies offer customers the choice of two or more depository options.

For a new customer, a custodian might waive the fee. But if you're transferring an existing retirement account, you'll have to deposit the money within 60 days or face a penalty.

The fees for buying and selling gold are not tax-deductible. You will still pay taxes when you take distributions.

A gold IRA allows you to invest in gold, silver, platinum and palladium. But the IRS requires that the gold meet specific purity and design standards.

A gold IRA can be a good way to diversify your IRA portfolio. It can protect you against inflation and market volatility. As the price of gold goes up, you can sell your gold for a higher profit.

However, your fees may include brokerage, buyback, maintenance, and storage costs. Your account may even have a flat fee or a percentage of your account's value.

Some gold IRA companies will charge a markup. Markups are based on the price of the asset and the market conditions.

#1

Goldco: Best business ratings & customer service

4.9/5